How Will Lexington’s Economy Grow Over the Next Two Years?

In February 27th’s Budget, Finance, and Economic Development (BFED) Committee, Councilmembers heard two presentations on Lexington’s industry, workforce, and tax revenue growth. They also heard a Monthly Budget Update on the Fiscal Year 2024 (FY24) budget.

While none of these presentations set concrete General Fund projections for the next Fiscal Year, the data presented are incredibly important as Council thinks about what the expected economic growth for Lexington will be over the next year, and how that may impact the upcoming budget.

Monthly Financial Update

As of January 2024, the current FY24 Budget is showing a deficit of just over $41 million. Importantly, this is almost entirely due to the Fund Balance allocations made by Council in late 2023. Without the use of Fund Balance dollars, this current year’s budget would have a surplus of $14 million.

Want a refresher on Fund Balances? Check out a quick explainer on our website.

The city is performing well on its current year’s adopted budget. Without accounting for the above Fund Balance transfer and expenses, the city is running a $14 million surplus.

Actual revenue earned by LFUCG is slightly outpacing the revenue projected in the Budget, largely due to higher-than-expected revenue from the Insurance Premium Tax and Investment Income.

Payroll Withholding Tax revenue is slightly overperforming Budget projections by 3%.

Compared to January 2023, Payroll Tax revenue is up 7%.

Net Profit Tax revenue from businesses is slightly higher than Budget projections by 1%, but is down from January 2023 revenue by 14%.

You can view the full presentation on page four of this packet.

Occupational Tax Forecast

Dr. Michael W. Clark of the University of Kentucky’s Center for Business and Economic Research provided an overview of revenue growth trends and projections for the two primary taxes LFUCG collects related to employment - the Payroll Withholdings Tax that comes straight from Lexington employees’ paychecks, and the Net Profits Tax which comes from profits and operational license fees from Lexington businesses.

Overall, Lexington is expected to continue its economic growth over the next Fiscal Year. However, that growth will slow down compared to the rapid growth seen in Fiscal Years 2022 (FY22) and 2023.

Fiscal Years in Lexington run from July to June - so FY23, for example, refers to the period from July 2022 to June 2023. Keep this in mind since we are not quite through FY24 yet, so we do not know the final numbers for FY24’s tax revenue.

Lexington’s Payroll Withholding Tax revenue is expected to grow, albeit at a slower rate than in past years.

In FY23, revenue from the Payroll Withholding Tax grew 7% from FY22. FY22’s growth was just over 10% from FY21.

FY24 Payroll Tax revenue is expected to grow by 5.7%, and FY25’s revenue growth is expected to be 3.5%.

Net Profit taxes are expected to decline in FY24 both in percentage and raw dollar amount, but are projected to bounce back in FY25.

Projected revenue for FY24’s Net Profits Tax is $66.9million, which is down 10.1% from FY23’s revenue earnings of $74.4million

FY25 is projected to bring in $ 68.9 million, which would be a 3% growth from FY24’s projected earnings.

When asked why he expected a decrease in FY24, Dr. Clark clarified that Net Profit taxes are the hardest taxes to forecast. However, he claimed that profits for businesses nationally were slowing down significantly and Lexington was likely to see that trend, which has already been reflected in previous LFUCG Budget updates to Council.

You can view the full presentation on page 22 of this packet.

Lexington Workforce Update

Director of Revenue Wes Holbrook and Director of Business Engagement Amy Glasscock presented an update on Lexington’s workforce.

As of June 2023, there were approximately 200,000 jobs in Fayette County. The top three job sectors are Healthcare/Education with ~54,000 jobs, Transportation/Trade/Utilities with ~35,800 jobs, and Professional/Business Services with ~30,000 jobs.

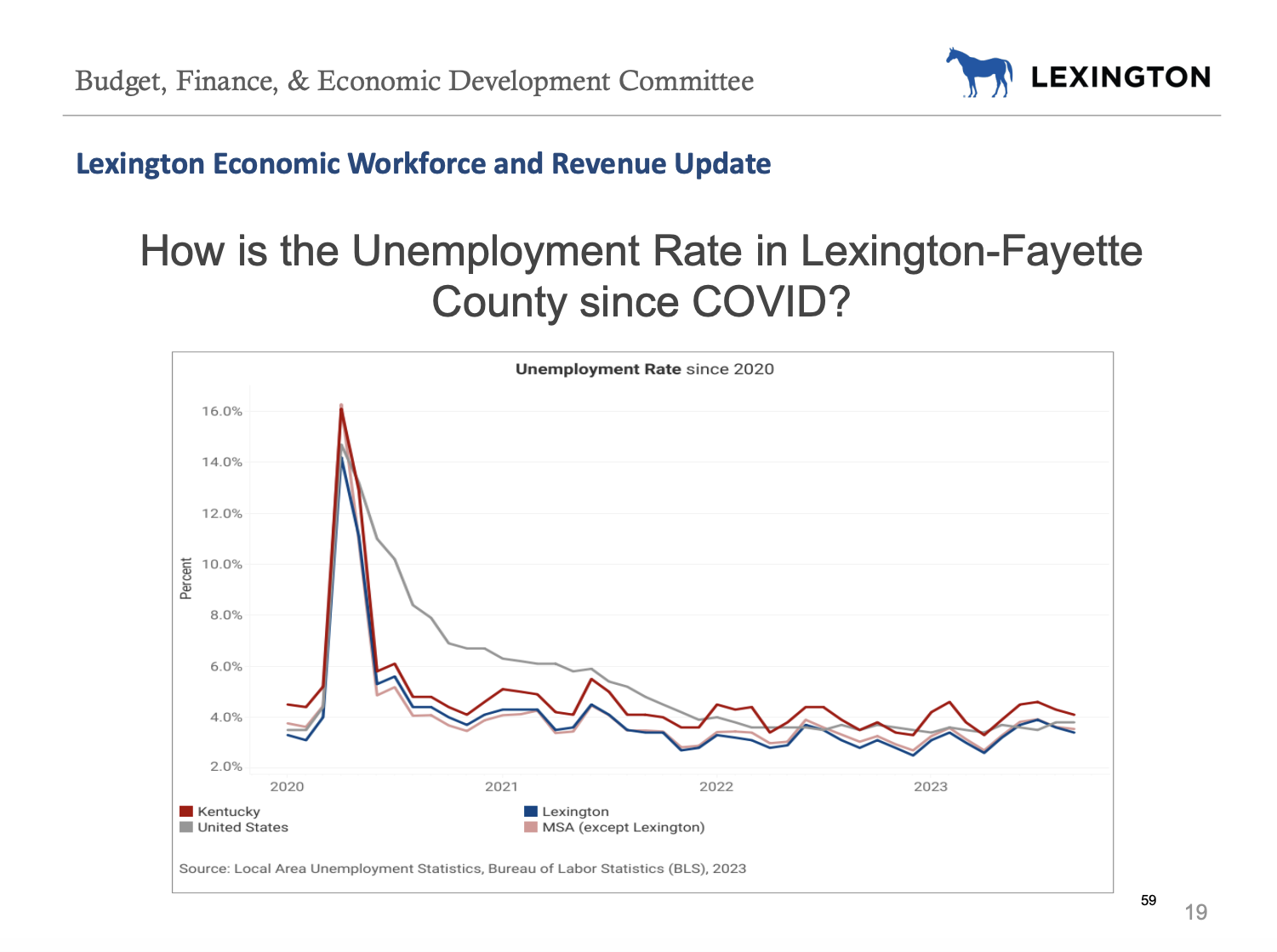

Lexington’s unemployment rate is 3.1% as of October 2023, which is roughly the same as January 2020’s unemployment rate. Lexington’s unemployment rate is lower than both the US as a whole, the Commonwealth of Kentucky, and most surrounding counties.

Both Lexington’s Labor Force and Workforce grew by roughly 38% from 1990 to 2022. As of 2022, 175,935 were in the Labor Force and 170,528 were employed in the Workforce as of 2022.

Labor Force refers to people who are able to work, regardless of whether they are working. Workforce refers to people who are actually working and employed.

Lexington’s Workforce grew by 8,359 people from 2020 to 2022, representing a particularly high rate of job growth. However, employment opportunities dropped dramatically in 2020 due to the COVID-19 pandemic, so future job growth will likely be much slower than the initial economic rebound seen in those two years.

On questions around Workforce, Chief Development Officer Kevin Atkins repeatedly emphasized the importance of Lexington’s competitiveness as a region. Lexington remains competitive with surrounding counties in attracting businesses looking for smaller sites of 20 acres or less, but businesses looking for larger sites often go to surrounding counties due to cheaper land. However, all companies looking in and around Lexington consider their potential workforce as all workers within an hour's radius of their potential location, so a regional approach is critical to getting Lexingtonians working in good-paying jobs according to Atkins.

Commerce Lexington will present to the BFED Committee next month an overview of their Regional Competitiveness Plan, which guides business recruitment strategies for the Central Kentucky region.

You can view the full presentation on page 41 of this packet.

What does this all mean for the City’s finances?

Together, these presentations show that Lexington’s economy grew rapidly in the aftermath of the COVID-19 pandemic in 2020. Lexington was able to leverage both rapid job and wage growth after 2020, and $121 million in Federal money through the American Rescue Plan Act (ARPA) to fund a slew of new projects relating to parks, public safety, social services, and much more.

All of the City’s ARPA money has been allocated, and some projects will need to be supplemented by the City’s own money to account for inflation increases since 2021. The phasing out of ARPA — in tandem with the stabilization of Lexington’s job and wage growth — will probably mean that Lexington’s budgets will be more constrained than they have been over the past two to three years. While growth will likely continue, it will probably be slower and more gradual, much like it was in the 2010s before COVID.

This does not mean that Lexington’s economic situation is bad or worse — rather, it means that the Budget process going forward will likely be more traditional and demand more negotiation than recent budgets.

The Budget, Finance, and Economic Development Committee Meeting was on Tuesday, February 27th. You can watch the archived recording on LexTV.